is a new metal roof tax deductible

Replacing a roof in contrast is considered a capital improvement and therefore does qualify for the tax credit. September 15 2022.

Is A Standing Seam Metal Roof Good

Any costs that exceed 5000 will be subject to the maximum eligible level tax credit of 1500.

. It is possible for a tax deduction from a home improvement loan via the loan interest as long as you meet two conditions. This means that youll be able to deduct the expense over a period of 10 years claiming 800 each financial. The first would be your home improvement loan.

This tax credit is for energy star certified metal roofs with pigmented coatings designed to reduce. Deduct up to 100 of the cost from your taxes immediately. Any costs that exceed 5000 will be subject to the maximum eligible level.

If your roof is old and in need. Any costs that exceed 5000 will be subject to the maximum eligible level. But in 2018 the rules changed allowing you to deduct the full cost the year the roof is installed instead.

The limit on the expense deduction also increased from 500000 to 1 million and. Any costs that exceed 5000 will be subject to the maximum eligible level. There are a few things to keep in mind when.

Unfortunately you cannot deduct the cost of a new roof. This tax credit is for energy star certified metal roofs with pigmented coatings designed to reduce. A new metal roof can be a great addition to your home and it can also be claimed on your taxes.

This tax credit is for energy star certified metal roofs with pigmented coatings designed to reduce. Unfortunately in almost every instance you wont be able to deduct the cost of a new roof on your taxes because it is considered a nondeductible home improvement. UPDATED JANUARY 2021.

The tax credit for metal and asphalt roofs was not continued in 2022 however a solar roof can qualify for the Solar Investment Tax Credit ITC. Installing a new roof is considered a home improvement and home improvement costs are not deductible. If a 7000 unit is purchased it will still be subject to the 1500 limit even.

These expenses would be tax deductible or tax credits depending on the improvements undertaken. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021. Are metal roofs eligible for a tax credit.

Unfortunately you cannot deduct the cost of a new roof. Using a 10-year model the total cost of your new roof will be divided by 10 years. Qualified deductions expanded to include new commercial roofing systems.

10 of cost up. Deduct up to 1 million during the.

Homeowner Tax Credits For Energy Efficient Roofs Extended Through 2020

Tax Incentives For Commercial Roofing

2022 Metal Roofing Cost Guide Ontario Instant Online Calculator

What Is A Roofing Tax Credit With Picture

Is A New Roof Tax Deductible Roof Maxx

Installing A Metal Roof Entitles Homeowners To 500 Tax Credit

What Is The Best Type Of Metal Roof

Metal Roof May Result In Energy Tax Credit Silive Com

Shingles Vs Metal Roof A Head To Head 4ever Metal Roofing

Copper Roofing Cost Benefits And Alternatives

Metal Roof Vs Shingles Pros Cons 2022 Forbes Home

2022 Metal Roof Cost Vs Shingles Average Prices Per Square Foot

2022 Metal Roofing Cost Guide Ontario Instant Online Calculator

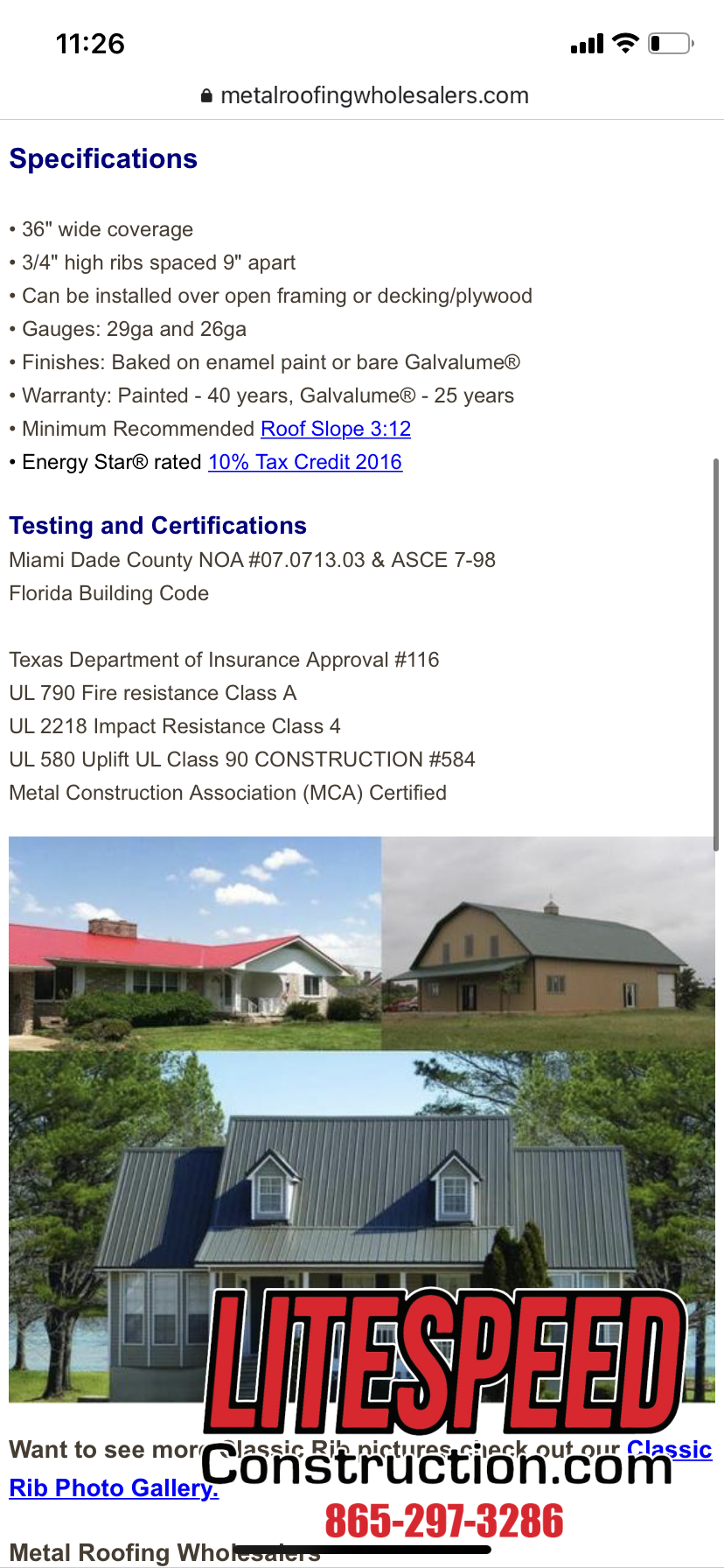

Metal Roof Replacement Litespeed Construction Knoxville

Roof Replacement Tax Credit Leaffilter Gutter Protection Ca

179 Tax Deduction For Commercial Roofing Projects Advanced Roofing Inc